Buying a car with less-than-perfect credit can be challenging, but it's not impossible. If you're looking for the best subprime auto lenders, you're in the right place. This guide will help you navigate the world of subprime auto financing and find the right lender for your needs. Whether you're rebuilding credit or facing financial challenges, understanding the options available can make a significant difference in securing the car you need.

The automotive industry offers numerous opportunities for borrowers, even those with subprime credit scores. However, finding the best subprime auto lenders requires careful research and consideration. With the right lender, you can secure a loan that meets your budget and helps improve your credit over time.

Our goal is to provide you with actionable insights and valuable information about the best subprime auto lenders. Whether you're a first-time buyer or a seasoned borrower, this article will guide you through the process of securing a subprime auto loan while ensuring you make informed decisions.

Read also:Who Is David Muirs New Wife Unveiling The Life And Story Behind The Scenes

Table of Contents

- Introduction to Subprime Lending

- How Subprime Auto Lending Works

- Key Features of Best Subprime Auto Lenders

- Top 10 Best Subprime Auto Lenders

- Factors to Consider When Choosing a Lender

- Common Mistakes to Avoid

- How to Improve Your Credit Score

- Subprime Loan Rates and Terms

- Tips for Negotiating Your Loan

- Conclusion and Next Steps

Introduction to Subprime Lending

Subprime lending refers to the practice of offering loans to borrowers with lower credit scores or limited credit history. These loans typically come with higher interest rates due to the increased risk for lenders. However, subprime loans can provide an opportunity for borrowers to improve their creditworthiness over time.

For many individuals, securing a car loan is essential for daily transportation and personal mobility. Subprime auto lending offers a viable solution for those who may not qualify for traditional financing options. By understanding the basics of subprime lending, borrowers can make smarter financial decisions.

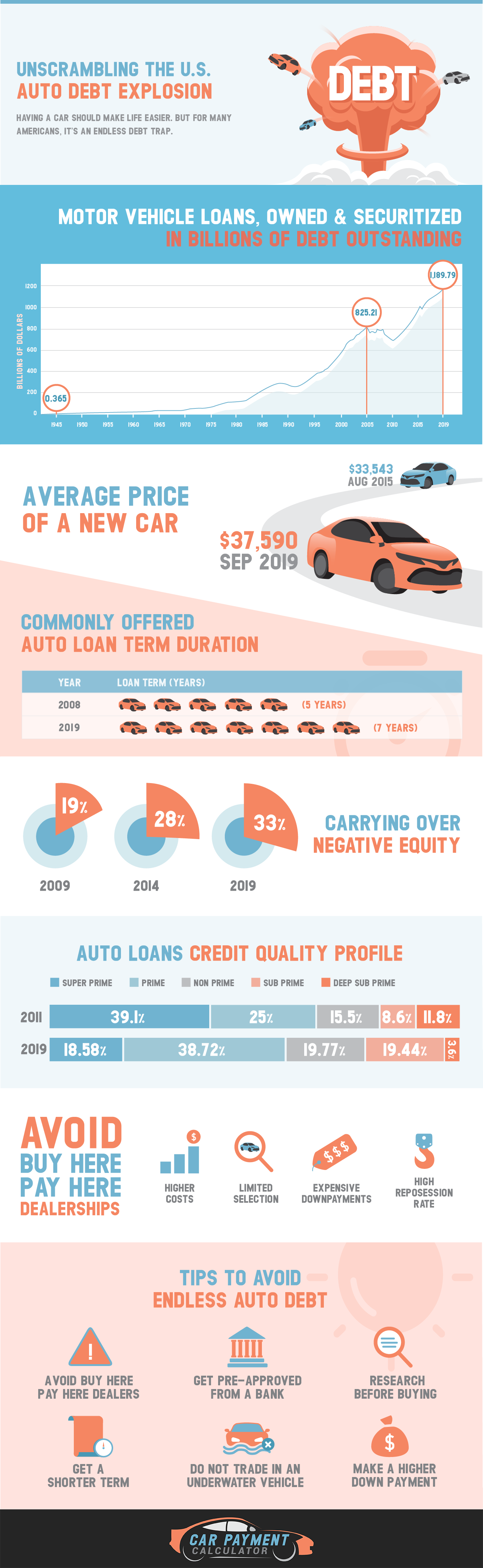

According to a report by Experian, subprime borrowers represent a significant portion of the automotive financing market. In 2022, subprime loans accounted for nearly 25% of all auto loans issued in the United States. This highlights the growing demand for flexible financing options in the automotive sector.

How Subprime Auto Lending Works

Understanding Subprime Credit Scores

Subprime credit scores generally range between 501 and 600. Borrowers within this range are considered high-risk due to their credit history or financial behavior. However, subprime auto lenders specialize in working with these borrowers, offering tailored solutions to meet their needs.

When applying for a subprime auto loan, lenders typically assess several factors, including:

- Credit score

- Employment history

- Monthly income

- Debt-to-income ratio

By evaluating these factors, lenders can determine the appropriate interest rate and loan terms for each borrower.

Read also:Jennifer Rauchet First Husband Unveiling The Truth Behind Her Love Story

Key Features of Best Subprime Auto Lenders

What Makes a Lender Stand Out?

The best subprime auto lenders share several key characteristics that set them apart from the competition. These include:

- Competitive Interest Rates: While subprime loans generally carry higher interest rates, the best lenders offer rates that are fair and transparent.

- Flexible Loan Terms: Borrowers should look for lenders that offer customizable loan terms to suit their financial situation.

- Positive Customer Reviews: A lender's reputation can be a strong indicator of their reliability and customer service quality.

Additionally, the best subprime auto lenders often provide resources to help borrowers improve their credit scores over time, ensuring long-term financial stability.

Top 10 Best Subprime Auto Lenders

1. Ally Financial

Ally Financial is one of the leading subprime auto lenders in the United States. Known for its competitive rates and flexible loan options, Ally caters to borrowers with varying credit profiles. Their online application process is straightforward, and they offer a wide range of vehicles to choose from.

2. Capital One Auto Finance

Capital One Auto Finance specializes in subprime auto loans, offering competitive rates and transparent terms. Borrowers can apply online or through a dealership, making the process convenient and hassle-free.

3. Santander Consumer USA

Santander Consumer USA provides financing options for borrowers with subprime credit scores. Their focus on customer service and flexible loan terms makes them a popular choice for many buyers.

For a comprehensive list of the top 10 subprime auto lenders, refer to our detailed analysis below:

Factors to Consider When Choosing a Lender

Interest Rates and Fees

One of the most critical factors to consider when choosing a subprime auto lender is the interest rate. While higher rates are expected, borrowers should aim to secure the lowest possible rate based on their credit profile. Additionally, it's essential to review any fees associated with the loan, such as origination fees or prepayment penalties.

Loan Terms and Repayment Options

The loan term and repayment options can significantly impact your monthly budget. Borrowers should carefully evaluate the loan term to ensure it aligns with their financial goals. Longer terms may result in lower monthly payments but could lead to higher overall costs due to accrued interest.

Common Mistakes to Avoid

When securing a subprime auto loan, borrowers should avoid common pitfalls that could negatively impact their financial situation. These include:

- Ignoring the total cost of ownership

- Not shopping around for the best rates

- Skipping the pre-approval process

By avoiding these mistakes, borrowers can ensure they make the most informed decision when selecting a subprime auto lender.

How to Improve Your Credit Score

Tips for Boosting Your Creditworthiness

Improving your credit score is crucial for securing better loan terms in the future. Some effective strategies include:

- Paying bills on time

- Reducing outstanding debt

- Limiting new credit inquiries

By implementing these strategies, borrowers can gradually improve their creditworthiness and increase their chances of securing more favorable loan terms.

Subprime Loan Rates and Terms

Subprime loan rates can vary significantly depending on the borrower's credit profile and the lender's policies. On average, subprime auto loans carry interest rates between 10% and 20%. However, some lenders may offer rates as low as 6% for borrowers with borderline subprime credit scores.

In addition to interest rates, borrowers should review the loan terms carefully. Common terms include:

- Loan duration (typically 36 to 72 months)

- Down payment requirements

- Repayment flexibility

Tips for Negotiating Your Loan

Maximizing Your Financial Advantage

Negotiating a subprime auto loan requires preparation and knowledge. Borrowers should:

- Research market rates and terms

- Prepare a detailed budget

- Be willing to walk away if terms are unfavorable

By approaching the negotiation process with confidence and preparation, borrowers can secure a loan that meets their needs and financial capabilities.

Conclusion and Next Steps

In conclusion, finding the best subprime auto lenders requires careful research and consideration of various factors. By understanding the nuances of subprime lending and evaluating your options thoroughly, you can secure a loan that aligns with your financial goals.

We encourage you to take the following steps:

- Review the top subprime auto lenders listed in this guide

- Compare loan terms and interest rates

- Reach out to lenders for personalized quotes

Don't forget to share your thoughts and experiences in the comments section below. Your feedback helps us improve and provide even more valuable content in the future. Thank you for reading, and best of luck in your journey to finding the perfect subprime auto lender!