In today's digital age, the term "transit number" has become increasingly relevant, especially for individuals and businesses involved in banking transactions. Whether you're sending or receiving money, understanding what a transit number is and how it works is crucial. This guide will delve into the intricacies of transit numbers, providing you with all the information you need to navigate this essential banking detail effectively.

Transit numbers play a pivotal role in financial transactions, ensuring that money moves from one account to another without errors. As we explore this topic further, you will gain insights into the significance of transit numbers, their structure, and how they contribute to the smooth functioning of banking systems worldwide.

By the end of this article, you will have a clear understanding of transit numbers, their applications, and how they impact your financial activities. Let's dive in and uncover the complexities and nuances of transit numbers in the banking industry.

Read also:Mikey Madison Ethnicity Exploring The Roots And Journey Of A Rising Star

What is a Transit Number?

A transit number, also known as a routing number or branch transit number, is a unique code assigned to a specific branch of a financial institution. This number is primarily used in domestic banking systems to identify the branch where an account is held. It plays a critical role in facilitating accurate and secure transactions between accounts within the same country.

Structure of a Transit Number

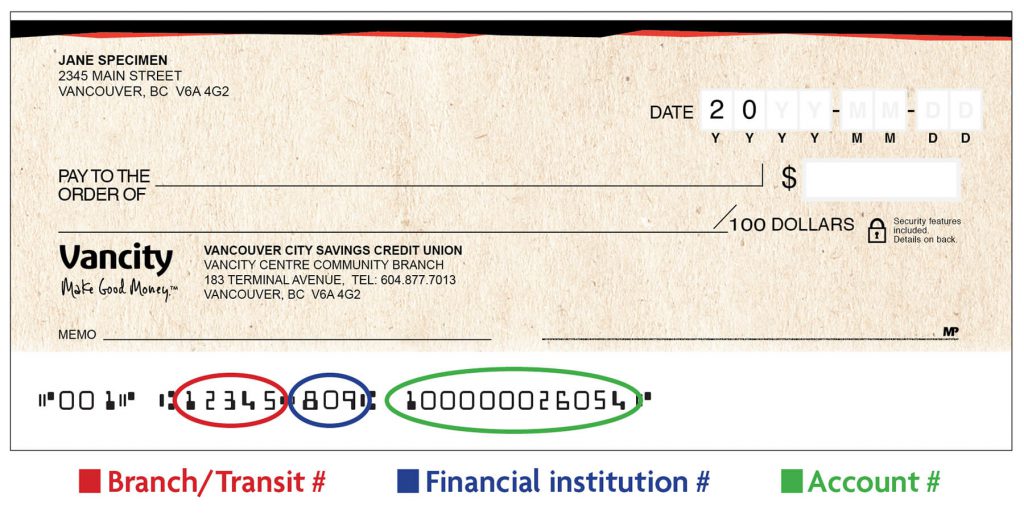

The structure of a transit number varies depending on the country and banking system. In Canada, for example, a transit number consists of five digits followed by a dash and then three digits. This format helps distinguish it from other types of identification numbers used in banking.

- Five-digit branch number

- Three-digit institution number

This structure ensures that each branch of a financial institution has a unique identifier, reducing the risk of errors during transactions.

How Transit Numbers Work

Transit numbers function as a bridge between different branches of financial institutions, ensuring that funds are transferred to the correct account. When you initiate a transaction, such as a direct deposit or electronic funds transfer (EFT), the transit number directs the funds to the appropriate branch and account.

Key Components of Transit Numbers

To better understand how transit numbers work, let's break down their key components:

- Branch Number: Identifies the specific branch of the financial institution.

- Institution Number: Identifies the financial institution itself.

Together, these components create a unique identifier that streamlines the transaction process and minimizes errors.

Read also:Sotwe Tuumlrkiye Discovering The Thrills And Opportunities Of Living And Working In Turkey

Importance of Transit Numbers in Banking

Transit numbers are indispensable in the banking industry, serving several critical functions:

- Ensuring accurate fund transfers

- Facilitating direct deposits and automated payments

- Providing a secure and reliable method for identifying bank branches

Without transit numbers, the complexity of modern banking systems would be nearly impossible to manage, leading to frequent errors and delays in transactions.

Transit Number vs. Routing Number

While the terms "transit number" and "routing number" are often used interchangeably, they have distinct meanings depending on the country. In the United States, a routing number refers to the American Bankers Association (ABA) routing transit number, which is a nine-digit code used for domestic transactions. In contrast, Canadian transit numbers consist of eight digits, including the dash.

Key Differences Between Transit and Routing Numbers

Here are some key differences between transit numbers and routing numbers:

- Length: Transit numbers are shorter than routing numbers.

- Format: Transit numbers include a dash, while routing numbers do not.

- Usage: Both serve similar purposes but are used in different countries.

Understanding these distinctions is essential for anyone conducting international transactions or working with financial institutions in multiple countries.

How to Find Your Transit Number

Locating your transit number is a straightforward process. Here are some methods you can use:

- Check Your Checks: The transit number is typically printed at the bottom of your checks, alongside the account number and check number.

- Online Banking: Most banks allow you to view your transit number through their online banking platforms.

- Contact Your Bank: If you're unsure where to find your transit number, you can always contact your bank's customer service for assistance.

Having easy access to your transit number ensures that you can provide it whenever needed, whether for setting up direct deposits or initiating wire transfers.

Common Uses of Transit Numbers

Transit numbers are utilized in various banking scenarios, including:

- Direct deposits

- Bill payments

- Wire transfers

- Inter-account transfers

Each of these applications relies on the accuracy of the transit number to ensure that funds are directed to the correct account. Understanding how and when to use your transit number can help you manage your finances more efficiently.

Security Considerations for Transit Numbers

While transit numbers are essential for banking transactions, they also pose potential security risks if not handled properly. Sharing your transit number with unauthorized individuals could lead to fraudulent activities or unauthorized access to your account.

Tips for Protecting Your Transit Number

Here are some tips to safeguard your transit number:

- Only share your transit number with trusted parties.

- Monitor your account activity regularly for any suspicious transactions.

- Use secure communication channels when transmitting sensitive financial information.

By following these guidelines, you can minimize the risk of fraud and protect your financial information.

Transit Numbers and International Transactions

While transit numbers are primarily used for domestic transactions, they can also play a role in international banking. When conducting cross-border transactions, you may need to provide both your transit number and a SWIFT code to ensure that funds are transferred accurately.

Challenges in International Banking

International transactions present unique challenges, such as:

- Different banking systems and regulations

- Currency conversion fees

- Time zone differences

Despite these challenges, transit numbers remain a vital component of the global banking infrastructure, helping to facilitate seamless transactions across borders.

Future of Transit Numbers in Banking

As technology continues to evolve, the role of transit numbers in banking may change. Innovations such as blockchain and digital currencies could transform how financial transactions are processed, potentially reducing the reliance on traditional transit numbers.

Emerging Technologies in Banking

Here are some emerging technologies that could impact the use of transit numbers:

- Blockchain: Provides a secure and transparent way to record transactions.

- Digital Currencies: Enables faster and more efficient cross-border transactions.

While these technologies hold promise, they also present challenges that must be addressed to ensure the continued security and reliability of financial systems.

Conclusion

In conclusion, transit numbers are a fundamental aspect of modern banking, ensuring accurate and secure transactions between accounts. By understanding their structure, function, and importance, you can better manage your financial activities and protect your sensitive information.

We encourage you to share your thoughts and experiences with transit numbers in the comments section below. Additionally, feel free to explore other articles on our site for more insights into the world of finance and banking. Together, let's build a more informed and secure financial future.

Table of Contents

- What is a Transit Number?

- Structure of a Transit Number

- How Transit Numbers Work

- Key Components of Transit Numbers

- Importance of Transit Numbers in Banking

- Transit Number vs. Routing Number

- Key Differences Between Transit and Routing Numbers

- How to Find Your Transit Number

- Common Uses of Transit Numbers

- Security Considerations for Transit Numbers

- Transit Numbers and International Transactions

- Future of Transit Numbers in Banking

- Emerging Technologies in Banking

- Conclusion

![Is Branch Number Same as Transit Number? [Canadian Banks] GlobalBanks](https://globalbanks.com/wp-content/uploads/2023/01/Is-Branch-Number-Same-as-Transit-Number-1.webp)