In today's fast-paced world, having access to quick financial solutions is more important than ever. MoneyLion cash advance offers a convenient way to bridge the gap between paychecks, providing users with the flexibility they need to manage unexpected expenses or financial emergencies. This service has become increasingly popular among individuals seeking short-term financial assistance without the hassle of traditional loans.

Whether you're facing an urgent car repair, medical bill, or simply need some extra cash to get through the month, MoneyLion cash advance can be a lifesaver. Unlike traditional banking services, MoneyLion provides a seamless and user-friendly platform that allows members to access funds quickly and efficiently.

However, it's crucial to understand how this service works, its benefits, potential drawbacks, and how to use it responsibly. In this comprehensive guide, we'll explore everything you need to know about MoneyLion cash advance, ensuring you make informed financial decisions.

Read also:Bill Nunn Net Worth Exploring The Career And Wealth Of The Iconic Actor

Table of Contents

- What is MoneyLion Cash Advance?

- How Does MoneyLion Cash Advance Work?

- Eligibility Requirements for MoneyLion Cash Advance

- Benefits of Using MoneyLion Cash Advance

- Costs and Fees Associated with MoneyLion Cash Advance

- Alternatives to MoneyLion Cash Advance

- MoneyLion Cash Advance Statistics

- Tips for Responsible Use of MoneyLion Cash Advance

- Common Misconceptions About MoneyLion Cash Advance

- Conclusion

What is MoneyLion Cash Advance?

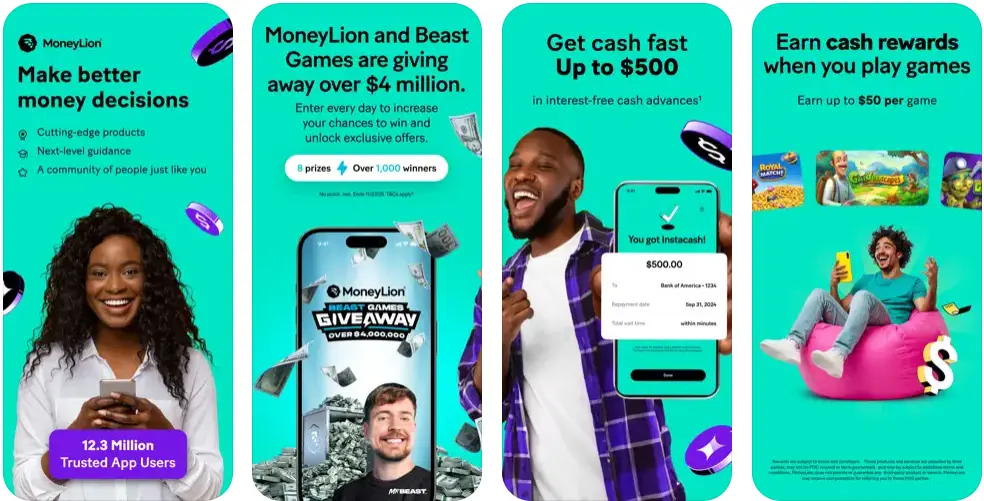

MoneyLion cash advance is a financial service offered by MoneyLion, a leading fintech company that provides a suite of financial tools and services aimed at helping individuals manage their finances better. This service allows users to borrow a small amount of money in advance, typically up to $250, which is deducted from their next paycheck. It's designed to provide short-term financial relief without requiring a credit check.

How MoneyLion Cash Advance Differs from Traditional Loans

Unlike traditional loans, MoneyLion cash advance does not require a credit check, making it accessible to individuals with poor or no credit history. Additionally, the application process is quick and straightforward, with funds often available within minutes of approval. This makes it an attractive option for those in need of immediate financial assistance.

Key features of MoneyLion cash advance include:

- No credit check required

- Quick and easy application process

- Small loan amounts (up to $250)

- Funds available within minutes

How Does MoneyLion Cash Advance Work?

The process of obtaining a MoneyLion cash advance is simple and user-friendly. Users must first sign up for a MoneyLion account and link their bank account. Once the account is set up, they can apply for a cash advance through the MoneyLion app or website. The requested amount is then deposited into their bank account, and the full amount is deducted from their next paycheck.

Steps to Apply for a MoneyLion Cash Advance

Here’s a step-by-step guide to applying for a MoneyLion cash advance:

- Sign up for a MoneyLion account and complete the registration process.

- Link your bank account to your MoneyLion profile.

- Log in to the MoneyLion app or website and navigate to the cash advance section.

- Enter the desired amount you wish to borrow (up to $250).

- Confirm the details and submit your request.

- Wait for approval, which usually takes just a few minutes.

- Once approved, the funds will be deposited into your bank account.

Eligibility Requirements for MoneyLion Cash Advance

While MoneyLion cash advance does not require a credit check, there are still certain eligibility criteria that applicants must meet. These requirements ensure that users have a stable income and are capable of repaying the advance when their next paycheck arrives.

Read also:Jaylar Page The Rising Star Of The Entertainment Industry

Key Eligibility Criteria

- Be at least 18 years old

- Have a valid Social Security number

- Have a verifiable source of income

- Have an active checking account

- Be a U.S. resident

Meeting these criteria increases the likelihood of approval, but it's important to note that MoneyLion reserves the right to deny applications based on internal assessments.

Benefits of Using MoneyLion Cash Advance

MoneyLion cash advance offers several advantages over traditional short-term loans and credit cards. Here are some of the key benefits:

1. No Credit Check

One of the most significant advantages of MoneyLion cash advance is that it does not require a credit check. This makes it an ideal option for individuals with poor or no credit history who may struggle to obtain traditional loans.

2. Quick Access to Funds

Once approved, funds are typically deposited into the user's bank account within minutes. This rapid turnaround time is crucial for those facing urgent financial needs.

3. User-Friendly Platform

MoneyLion's app and website are designed to be intuitive and easy to navigate, making the application process seamless and stress-free.

Costs and Fees Associated with MoneyLion Cash Advance

While MoneyLion cash advance offers convenience and accessibility, it's important to understand the associated costs and fees. Unlike traditional loans, MoneyLion does not charge interest on cash advances. Instead, users are charged a one-time fee based on the amount borrowed.

Fee Structure

- $5 fee for every $100 borrowed

- Maximum fee of $25 for a $250 advance

While the fees may seem reasonable, it's essential to consider the overall cost when deciding whether to use this service. For example, borrowing $250 would result in a total repayment of $275, which equates to a 10% fee.

Alternatives to MoneyLion Cash Advance

While MoneyLion cash advance is a convenient option, there are other alternatives worth considering depending on your financial situation. These alternatives may offer lower fees or more flexible repayment terms.

1. Payday Loans

Payday loans are similar to MoneyLion cash advance but often come with higher fees and stricter repayment terms. However, they may be available to individuals who do not qualify for MoneyLion's services.

2. Credit Cards

For those with access to a credit card, using it for small purchases or cash advances may be a more cost-effective option. Credit cards typically offer lower interest rates compared to cash advance fees.

3. Personal Loans

Personal loans from banks or credit unions may provide larger loan amounts and longer repayment terms, making them a better option for larger financial needs.

MoneyLion Cash Advance Statistics

MoneyLion has become a popular choice for millions of Americans seeking financial assistance. According to recent data:

- Over 4 million users have signed up for MoneyLion services.

- More than 70% of users report improved financial health after using MoneyLion's tools.

- The average user saves $1,200 annually by using MoneyLion's financial management features.

These statistics highlight the growing demand for accessible and user-friendly financial services like MoneyLion cash advance.

Tips for Responsible Use of MoneyLion Cash Advance

While MoneyLion cash advance can be a valuable tool, it's important to use it responsibly to avoid financial pitfalls. Here are some tips to ensure you make the most of this service:

1. Borrow Only What You Need

Limit your borrowing to the minimum amount required to cover your immediate expenses. This reduces the overall cost of the advance.

2. Plan for Repayment

Make sure you have a clear plan for repaying the advance when your next paycheck arrives. This helps prevent financial strain and ensures you can continue using MoneyLion's services in the future.

3. Explore Other Options

Before using MoneyLion cash advance, consider other alternatives that may offer better terms or lower costs, especially for larger financial needs.

Common Misconceptions About MoneyLion Cash Advance

There are several misconceptions about MoneyLion cash advance that can lead to confusion or misinformation. Here are some of the most common myths:

1. It's a Loan

MoneyLion cash advance is not technically a loan. It's an advance on your next paycheck, meaning the full amount is deducted once you receive your salary.

2. It Requires a Credit Check

Contrary to popular belief, MoneyLion cash advance does not require a credit check. This makes it accessible to individuals with poor or no credit history.

3. It's Expensive

While MoneyLion cash advance charges a one-time fee, it's generally less expensive than traditional payday loans. Understanding the fee structure can help you make an informed decision.

Conclusion

MoneyLion cash advance offers a convenient and accessible solution for individuals in need of short-term financial assistance. By understanding how the service works, its benefits, costs, and responsible usage tips, you can make informed decisions about whether it's the right option for your financial needs.

We encourage you to share your thoughts and experiences with MoneyLion cash advance in the comments section below. Additionally, don't hesitate to explore other articles on our site for more insights into personal finance and financial management tools.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making any financial decisions.