Loans have become an essential financial tool for individuals seeking to achieve their goals, whether it's buying a home, financing education, or starting a business. Among the many lenders available, TD Bank stands out as a trusted institution offering the TD Fit Loan, designed to meet the diverse needs of borrowers. Understanding the TD Fit Loan requirements is crucial for anyone considering this financial product.

In today's dynamic financial landscape, having access to the right loan can make all the difference. TD Fit Loan offers personalized solutions tailored to individual circumstances, making it a popular choice among borrowers. This article dives deep into the specifics of TD Fit Loan requirements, helping you make informed decisions about your financial future.

By the end of this guide, you'll have a comprehensive understanding of what TD Fit Loan entails, the eligibility criteria, the application process, and tips to increase your chances of approval. Let's explore the world of TD Fit Loans and discover how it can benefit you.

Read also:Holly Herbert The Rising Star Redefining The Entertainment Industry

Table of Contents

- Introduction to TD Fit Loan

- Eligibility Criteria for TD Fit Loan

- The Application Process

- Types of TD Fit Loans Available

- Understanding Interest Rates

- The Importance of Credit Score

- Income Requirements for TD Fit Loan

- Required Documentation

- Benefits of TD Fit Loan

- Tips for a Successful Application

Introduction to TD Fit Loan

What is TD Fit Loan?

TD Fit Loan is a specialized lending product offered by TD Bank, one of North America's leading financial institutions. Designed to cater to the unique financial needs of individuals, TD Fit Loan provides flexible terms, competitive interest rates, and personalized options. Whether you're looking to consolidate debt, finance a major purchase, or invest in your future, TD Fit Loan can be a valuable asset.

Why Choose TD Fit Loan?

Among the many loan options available, TD Fit Loan stands out due to its customer-centric approach. TD Bank prioritizes transparency, ease of access, and personalized service, ensuring that borrowers receive the support they need. Key features of TD Fit Loan include:

- Flexible repayment terms

- Competitive interest rates

- Streamlined application process

- Support for various financial goals

Eligibility Criteria for TD Fit Loan

Before applying for a TD Fit Loan, it's important to understand the eligibility requirements. TD Bank has established specific criteria to ensure that borrowers are capable of repaying the loan responsibly. Below are the key eligibility factors:

Age Requirements

To qualify for a TD Fit Loan, applicants must be at least 18 years old. This ensures that borrowers are legally capable of entering into a binding financial agreement.

Citizenship and Residency

TD Fit Loan is available to Canadian citizens, permanent residents, and eligible visa holders residing in Canada. Proof of residency may be required during the application process.

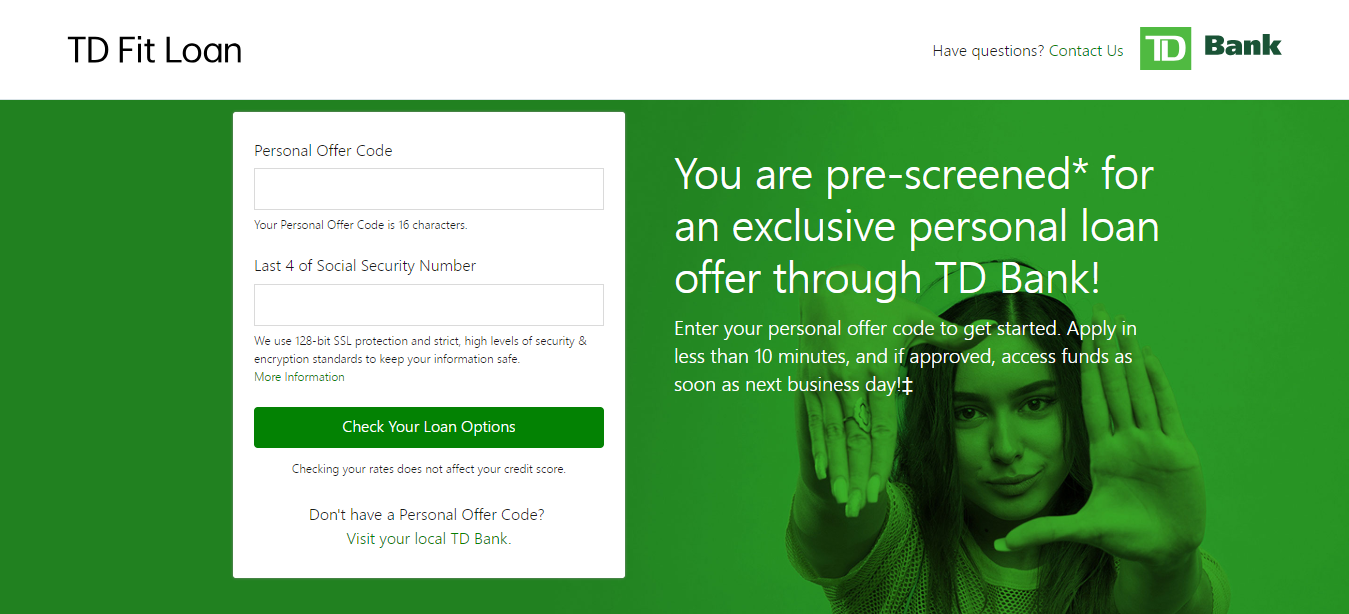

The Application Process

Applying for a TD Fit Loan is a straightforward process that can be completed online, in person, or over the phone. TD Bank offers multiple channels to accommodate the preferences of its customers. Here's a step-by-step guide to the application process:

Read also:Mackenyu Wife Photo A Comprehensive Look Into The Life Of Mackenyus Partner

Step 1: Gather Required Documents

Before starting the application, ensure you have all necessary documents ready. These may include proof of income, identification, and financial statements.

Step 2: Submit Your Application

You can apply for a TD Fit Loan through the TD Bank website, by visiting a branch, or by calling customer service. The online application process is convenient and allows you to track the status of your application.

Types of TD Fit Loans Available

TD Bank offers several types of TD Fit Loans to suit different financial needs. Below are some of the most popular options:

Personal Loans

Personal loans from TD Bank can be used for a variety of purposes, such as consolidating debt, financing a vacation, or covering unexpected expenses.

Home Improvement Loans

If you're planning to renovate or upgrade your home, a TD Fit Loan can provide the necessary funds. These loans are tailored to meet the specific needs of home improvement projects.

Understanding Interest Rates

Interest rates for TD Fit Loans are determined based on several factors, including the applicant's credit score, income, and loan amount. TD Bank offers competitive interest rates, making it an attractive option for borrowers. Here's a breakdown of how interest rates are calculated:

Fixed vs. Variable Rates

TD Fit Loans offer both fixed and variable interest rate options. Fixed rates remain constant throughout the loan term, while variable rates may fluctuate based on market conditions.

The Importance of Credit Score

Your credit score plays a significant role in determining your eligibility for a TD Fit Loan and the interest rate you'll receive. TD Bank uses credit scores to assess the risk associated with lending to a particular borrower. Here are some tips to improve your credit score:

- Pay bills on time

- Keep credit card balances low

- Avoid frequent credit inquiries

Income Requirements for TD Fit Loan

To qualify for a TD Fit Loan, applicants must demonstrate a stable source of income. TD Bank evaluates income based on employment history, salary, and other financial factors. Here's what you need to know:

Employment Verification

TD Bank may require proof of employment, such as pay stubs or a letter from your employer, to verify your income. Self-employed individuals may need to provide additional documentation, such as tax returns or bank statements.

Required Documentation

When applying for a TD Fit Loan, it's essential to have all required documentation ready. This ensures a smooth and efficient application process. Common documents include:

- Government-issued ID

- Proof of income

- Residency verification

- Financial statements

Benefits of TD Fit Loan

TD Fit Loan offers numerous advantages that make it a popular choice among borrowers. Below are some of the key benefits:

Flexible Repayment Terms

TD Fit Loan allows borrowers to choose repayment terms that fit their budget and financial goals. This flexibility ensures that borrowers can manage their payments effectively.

Competitive Interest Rates

With competitive interest rates, TD Fit Loan provides borrowers with cost-effective financing options. TD Bank regularly reviews its rates to ensure they remain competitive in the market.

Tips for a Successful Application

Improving your chances of approval for a TD Fit Loan requires careful preparation and attention to detail. Here are some tips to help you succeed:

- Review your credit report for errors

- Ensure all required documents are complete

- Be prepared to explain any financial challenges

Conclusion

In conclusion, understanding TD Fit Loan requirements is essential for anyone considering this financial product. By meeting the eligibility criteria, gathering the necessary documentation, and following best practices, you can increase your chances of approval and secure the funding you need.

We encourage you to take action by exploring TD Fit Loan options and applying today. Don't forget to share this article with others who may find it helpful, and feel free to leave a comment below with any questions or feedback. Together, let's unlock your financial potential with TD Fit Loan!

For more information, visit TD Bank's official website or consult with a financial advisor for personalized advice.